A Limited Liability Company helps you separate your personal finances from those of your business. If you’ve formed one, you need a separate business bank account for your LLC.

Making the right choices when your business is still young can go a long way. This is especially true when it comes to choosing the right business bank accounts. But since there are so many options, picking one isn’t easy.

Find out everything you need to choose the best small business bank accounts for an LLC in this comprehensive guide.

Quick View on the Best Business Bank Accounts for LLCs

- Bluevine – Best LLC Bank Account Overall

- Novo – Best for Low Fees

- American Express – Best for Membership Rewards

- Capital One – Best for Unlimited Transactions

- Bank of America – Best for Traditional Banking

- Axos – Best Full-service Online Bank

- Lili – Best for One-Person Businesses

- US Bank – Best for Lending Options

- Oxygen – Best for Freelancers

- Chase – Best for Cash Deposits

Product or Service

Fees

Interest Rates

Lending

Rewards and Benefits

Support

No maintenance fee –

$4.95 per cash deposit

Earn up to 2.0% APY

Funds available with a click, no opening or prepayment fees

Deposit cash and checks at Green Dot locations

Business hours phone support; email, chat, and support docs

$50 required to open

Earn 0% APY

No lending options

Free ATM access, discounts to some software

Business hours phone support; support docs

No maintenance fee

Earn 1.3% APY on up to $500K

Between $2,000 and $250,000; no prepayment penalty

Membership Rewards program

24/7 support

Basic checking account – $15 monthly fee*

Business savings accounts – .01% APY

Business credit card, loans, and lines of credit

Unlimited digital transactions

Full-service support

Fundamentals – $16*

Maintain a $5,000 balance

Business credit cards, loans, and lines of credit

200 or 500 teller transactions and checks written w/no fee

Small business specialists, plus resources

Basic Business – no monthly fee

- Interest Checking – up to 0.81%

- Business Savings – 0.20%

Lines of credit and loans

ATM fee reimbursements

24/7 phone support

Standard – monthly fee-free, no overdraft fee, no ATM fee

Pro – 1% APY

$200 overdraft protection

Pre-fill 1040 forms

Business hours email support

Silver – $0 monthly fee, $0.50/transaction after 125

Earn 0.01% APY

Credit cards, lines of credit, and loans

Send and request money

Phone support, support docs

Earth – No monthly maintenance fees

- Earth – 0.25%

- Water – 0.75%

- Air – 1.00%

- Fire – 1.25%

No lending

Netflix and Peloton reimbursement, cell phone protection plan

Support docs, limited email, and phone support

Business Complete – $15/month*

Inquire for interest options

Loans and lines of credit, Chase products

Same day deposits

Physical locations, business hours phone and email support

Best LLC Bank Account – Quick Verdict

Best Overall – Bluevine. Bluevine is the best overall option because it’s well-balanced, has no transaction fees, and also provides a lending option for those that qualify. It’s a well-balanced checking account option for businesses just starting out or LLCs that have been around for a while. You can quickly open a business bank account and be ready to go within minutes.

Best Small Business Bank Accounts for an LLC

The best business bank accounts for LLCs vary greatly depending on the amount of money you plan on moving through the account and how many deposits you need to make. Most are free but some, especially traditional options, require transaction fees that you’ll need to pay attention to. Here’s a detailed look at the best small business account options for LLCs below and how they stack up.

A Bluevine business checking account provides a basic online business checking account option that is very well-rounded for most small businesses. You can pay bills, apply for small loans in minutes, and even earn a decent interest rate, all without any monthly fees.

The application process is simple and can be completed in minutes, with the possibility of your account up and running on the same day. All these features make Bluevine one of the best banks for startups and for businesses in general. Read our complete review on Bluevine if you’re interested in opening a business account with it.

Fees

Bluevine charges no maintenance, NSF, or deposit fees, which goes beyond the industry standard. You can complete as many transactions as you need without incurring additional fees. Bluevine has no minimum balance or minimum deposit requirements either.

Interest Rates

Bluevine also offers a great APY on its checking account, giving users up to a 2.0% return on balances up to and including $100,000. This is only available to account holders who either spend $500 per month on their debit card or receive $2,500 per month in customer payments into their checking account.

Lending

You can also avail of business lines of credit of up to $250,000 at rates as low as 4.8%. The application process is fast and easy and you can often get a decision in under five minutes. Bluevine charges no fees for opening, maintaining, prepayment, or account closure.

- No minimum deposit

- Unlimited transactions

- Two free checkbooks

- Virtual bank (through Coastal Community Bank).

- Only allow cash deposits through Green Dot Services

- No business savings accounts

Why we chose it: With non-existent banking fees and one of the most lucrative APYs in the market, Bluevine is a top choice for opening a bank account for LLCs. Sign up today.

Novo is a great checking account for small businesses because of its easy-to-use platform, straightforward application process, and ability to make digital payments seamlessly. You can complete and submit your application in under 10 minutes and get a quick response with any missing information. As soon as your account is approved and you make your first deposit of at least $50, you can start using your checking account.

Novo thrives with its easy-to-use mobile app. Since the bank offers free ACH transfers you can easily sign in to your app via your mobile device and pay bills, send money, run payroll, or transfer money to your personal account within seconds. You always have your banking details and transactions at your fingertips to help you stay on top of your financial obligations. The app also gives you a nice overview of what you’re spending and bringing in each month.

Fees

Novo charges no fees for its checking account service. You only need an opening deposit of $50 to get your account running. There are no minimum balance requirements, cash deposit fees, incoming wire fees, or ACH fees with this bank. Novo also refunds all ATM fees and is backed by FDIC insurance through Middlesex Federal Savings, F.A.

Interest Rates

Novo charges no fees for its business checking account, much like Bluevine. However, you have to forgo earning interest for it. The bank offers no interest on your checking account deposits.

Lending

Novo offers no lending options. It’s purely a checking account service and does not offer loans, lines of credit, or even a business credit card. Want a loan? Then here’s a list of the best bad credit loans available for you.

- Unlimited fee-free business checking transactions

- Unlimited ATM fee refunds

- Smooth integrations with third-party software like Shopify and QuickBooks

- No lending options

- No cash deposits

- No lines of credit or loans

Why we chose it: With its great mobile app and integrations with software like Shopify and QuickBooks, Novo is one of the best low-fee options out there. Read our Novo review for an in-depth analysis of its checking account service. Sign up today.

American Express Business Checking follows a newer trend in business banking, offering more fee-free services and not requiring a minimum balance for its basic business checking account. You can also charge unlimited transactions through their payment services. If you’re looking for Kabbage business checking, you’d be surprised to know that Kabbage was acquired by American Express.

American Express Business Checking is a great option for business owners who want to get a line of credit and a bank account. It offers easy loan approval for small businesses for lines of credit of up to $250,000 with Kabbage Funding by American Express. Read our full Kabbage Funding review to find more. Don’t forget also our other reviews of other business bank accounts like NBKC Bank Account Review and SoFI Review.

Fees

American Express Business Checking has no monthly fees. There’s no minimum opening deposit requirement and no online transaction fees either. You can use all MoneyPass ATMs for free, however, using an out-of-network ATM will cost you around $3 per transaction. Cash deposits aren’t supported by American Express.

Interest Rates

This bank account has one of the highest APYs, offering a 1.30% return on balances of up to $500,000, though it does fall short of Bluevine’s generous 2.0% return. American Express Business Checking’s APY doesn’t beat that of Bluevine, still, it’s the second-highest on this list.

Lending

The best thing about opening an account with American Express is that it also has Kabbage Funding which offers easy loan approval for lines of credit of up to $250,000. It’s a great option even if you don’t have a high credit score. You can get your application approved with a FICO score of 640.

With Kabbage Funding, you’re going to receive a simple application process on both the checking and the line of credit products. Kabbage can use your banking history to get you approved for a line of credit automatically and if you’re initially denied you can show history by using a Kabbage checking account and they’ll auto-approve you when your account shows you should be.

- Easy line of credit, no prepayment charges

- No minimum balance

- Easy application process

- Mobile check deposits only available on iOS

- Cash deposits not supported

- Only available to American Express customers

Why we chose it:

American Express Business Checking offers all the services of a traditional business account but with the convenience of an online bank. It offers an attractive APY and is perfect if you also need a business line of credit. Sign up today.

Capital One offers two different options for business checking accounts. The Basic account is just that, offering unlimited electronic deposits, online and mobile banking, and a relatively low minimum balance to waive fees. The Unlimited business bank account includes two Basic accounts, so might be a good fit for businesses with complicated finances.

Capital One is a very traditional banking company but it blows the other traditional banks out of the water with its app and ease of use for your account. Capital One also offers a lot of other products, such as credit cards, that you might qualify for if you’re able to get approved for their business checking account.

The bank’s experienced and highly responsive customer service is one of its strongest features. If you’re interested, bear in mind that Capital One’s business checking is only available in a few states. You also need to visit a branch in-person to apply for a business checking account.

Fees

Capital One’s Basic Checking account comes at a monthly fee of $15, which is steep compared to American Express’s zero maintenance fee. However, the fee can be waived if your balance exceeds $2,000. Cash deposits are free for up to $5,000 in deposits per month. Standard wire transfer fees are charged with this product.

The Unlimited Checking account has a monthly fee of $35 which can be waived with a minimum balance of $25,000. This account has free cash deposits with no limits. All incoming wires are free. You also get five free outgoing wire transfers per month.

Interest Rates

Capital One offers no APY on its checking account. However, you can earn interest at 0.2% with a savings account.

Lending

Capital One offers small business loans and lines of credit but you can only avail of these if you have your checking account with it. It offers one of the largest lines of credit of up to $5 million. If you are looking for a longer repayment term, fixed rates, and lower equity requirements, it also has SBA 504 and SBA7(a) loans.

- Experienced support from a large bank

- Self-service escrow services

- Unlimited checking includes two Basic accounts

- High balances to waive fees

- Only available in some states

- Have to visit a branch to apply for an account

Why we chose it:

Capital One offers a similar range of services to other large banks, with similar pricing. It’s a great option if you prefer to do your banking through physical branches. Sign up today. Read our in-depth review of Capital One to learn more about its services.

Bank of America business checking accounts are only one of several products that BofA offers to small businesses. The two levels are similar to Chase and Capital One, with two different levels of service aimed at smaller and larger businesses.

Bank of America is the epitome of a traditional bank. While it has online capabilities with a decent app, it’s still not as simple to use as other options. Plus, the fee structure is not built with small businesses in mind due to the large balances required to waive those fees.

Fees

Bank of America offers two types of business checking accounts, Business Advantage Fundamentals, and Business Advantage Relationship banking. The Fundamentals account has a monthly fee of $16 but it can be waived off if you maintain a $5,000 combined average monthly balance, spend at least $250 in new net qualified debit card purchases each statement cycle, or join the Preferred Rewards for Business program.

The Relationship checking account has a monthly fee of $29.95 but can be waived off with a combined average monthly balance of $15,000. If you open a savings account, it has a fee of $10 per month but can be waived off with a $2,500 minimum daily balance.

Interest Rates

Bank of America’s checking account offers no interest earnings. You can earn only a very minimal interest at 0.01% APY with the business savings account, which is far below the 2.0% return from Bluevine.

Lending

When it comes to lending, Bank of America offers a business credit card, secured business loans from $25,000 to $250,000, and secured lines of credit from $25,000. It offers plenty of lending options but you need a minimum credit score of 700 to qualify.

- Integrated with Zelle money transfer.

- Online account integrates with accounting apps

- Payroll services

- High balances to waive fees

- App isn’t as easy to use as other options

- High monthly service fees

Why we chose it:

Bank of America offers a well-established set of business banking options. It’s a great option if your business deals with heavy cash flows. Read our Bank of America review for an in-depth analysis of its account types. Sign up today.

Axos is a virtual bank in that it only offers online business banking, not backed by physical locations. However, it doesn’t depend on another financial institution, unlike some competitors. It’s a bank in its own right. Axos regularly shows up on lists of ‘Best Business Checking Accounts’ across the web due to its generous terms and range of services.

Axos is an online-first bank that is easier to navigate and use than most traditional banking options. It prides itself on building a great online presence and experience for its customers, which makes it a terrific option for small or digital businesses. Unfortunately, the APY you’ll earn is up to only 0.20% for basic checking or 1.01% for interest checking if you carry a minimum balance of $5,000.

Fees

Axos offers four main types of business bank accounts. Basic Business Checking, Business Interest Checking, Business Savings Account, and Business Premium Savings.

Basic Business Checking has no monthly fee, but Business Interest Checking comes at a fee of $10 per month. Basic Savings has a monthly fee of $5 while its Premium version has none.

Interest Rates

While Axos’ customers have plenty of interest-bearing options, the yield rates aren’t as high as some of the other banks. The basic checking account has no APY. The interest-bearing checking account has an APY of 1.01%.

If you go with Axos’ savings options, you get a 0.20% yield on both the Basic and Premium Business Savings accounts.

Lending

Axos Bank partners with Centerstone SBA Lending to support businesses with SBA loans. They provide a federally backed guarantee and offer flexible terms. It also has commercial lines of credit and term loans but these are best for large corporations.

- No monthly fee and unlimited transactions

- Cash deposits allowed via MoneyPass and AllPoint ATMs

- Wide range of interest-bearing options

- No physical locations

- Limited integrations

- Doesn’t offer the highest APY

Why we chose it:

Axos is a full-service online bank and is a great option for any business that wants to keep all its banking online. It offers low fees and free cash deposits across all MoneyPass and AllPoint locations across the US. Read our in-depth review on Axos bank to learn more about its services. Sign up today.

Lili is perfect for small, one-person operations. It straddles the awkward and occasionally non-existent division between personal bank accounts and business checking accounts for small businesses. Although it’s FDIC-insured, it’s not a traditional bank.

It provides business checking account options, particularly invoicing, without some superfluous and expensive features. You do miss out on lending and merchant services options, however. Also of help to a ‘tiny business’ is the free online bill payments, making it one of the best business accounts for a one-person LLC.

Fees

Lili’s standard banking services are free. There’s no monthly fee, overdraft fee, ATM fee, or minimum balance requirement, similar to the best business bank account for LLCs: Bluevine. However, if you go with Lili Pro, it costs you $4.99 per month on account of the additional services you receive.

Interest Rates

You won’t get an APY on Lili’s standard offerings. If you go with Lili Pro, you can get up to 1% APY with a savings account. The Automatic Savings feature lets you set up an automatic transfer of at least $1 a day to your savings account.

Lending

Lili is far from a traditional bank and so it has very limited lending options. All you can excerpt is a free overdraft of up to $200 on debit card purchases.

- Easily separate business and personal transactions

- Offers tax optimizer tool

- Create and send invoices

- Virtual bank (through Choice Financial Group)

- No real lending or merchant services

- Not good for bigger businesses

Why we chose it:

Lili is designed to handle the sometimes blurred lines between personal and business finances common with single-person concerns. It’s a good choice for freelancers and one-person businesses and has innovative features including Automatic Savings and Tax Optimizer. Read our in-depth review of Lili bank to learn more about its services. Sign up today.

Unlike its colleagues on this list, US Bank forgoes a monthly maintenance fee on their basic US Bank Silver business checking account, opting instead for transaction fees. This might be a good fit for businesses without a large number of transactions each month, such as a contractor with a single major client.

The fees on more expensive accounts can be waived by meeting minimum balance requirements or one of several other criteria. As long as you’re only running a few transactions each month, US Bank might offer a good account for your LLC.

Fees

US Bank offers three checking accounts. The Silver Business Checking Account package has no monthly fee and 125 free transactions per month. Every transaction is charged $0.50 if the count exceeds 125.

The Gold package comes at a $20 monthly fee and $0.45 per transaction after they cross the 300 limit. The Platinum package has a $30 monthly fee and costs $0.40 per transaction after 500 transactions per month. All these fees are pricey if you compare US Bank to the top-ranked Bluevine, which charges zero fees.

Interest Rates

US Bank doesn’t offer any yields on checking account deposits. When it comes to its savings account, you can earn 0.01% APY with a minimum deposit of $25.

Lending

This financial institution offers a range of lending options including business credit cards, lines of credit, and loans. US Bank has a range of business credit cards that offer different features including cash backs, no annual fees, low interest rates, and rewards programs.

It also offers a wide variety of small business loans that you can choose from to fit your business needs. Loan amounts go up to $250,000 with Quick Online loans and $12.375 million with government-backed loans.

- Lending to fit your needs

- Specialized merchant services for restaurants, retailers, and service providers

- Small business specialists

- Charges transaction fees

- No APY on checking accounts, very low APY on savings accounts

- High early withdrawal penalties on CDs

Why we chose it:

US Bank has a range of great products and services. Its lending options are its strongest selling point. It’s a good choice for any business that has a low transaction count. Read our in-depth review on US bank to learn more about its services. Sign up today.

Looking at Oxygen’s website, you might think it’s a fashion magazine or trendy boutique. However, it offers a business checking account through its online-only bank. There is a fee-free option and, unusually, options with an annual fee. Oxygen is perfect for a freelancer that is just looking to separate their personal and business finances.

In fact, Oxygen is explicitly aimed at trendy small business owners or freelancers, with your choice of element-themed business bank account online. Don’t let the fancy presentation put you off, though, as it has some features that make it one of the best business bank accounts for freelancers, like cell phone and lost luggage protection. Perhaps most importantly, Oxygen will help you form an LLC with its business registration services.

Fees

Interestingly, Oxygen divides its services into the elements Earth, Water, Air, and Fire. It calls these loyalty tiers that are created to help business owners succeed in their own way.

The Earth tier is the most basic offering and comes at no fees. The savings option in the Earth tier earns you up to 0.50% APY. Water is the next tier that costs $19.99 per year. It offers a range of features plus 1.00% APY on savings. Air and Fire tiers cost $49.99 and $199.99 annually and offer an APY of 2.00 and 3.00% on savings.

Interest Rates

Oxygen has some lucrative interest rates with its savings option for each tier. You can earn with an APY of 0.50%, 1.00%, 2.00%, and 3.00% on the Earth, Water, Air, and Fire elements respectively. These interest rates are quite a bit higher than even Bluevine and American Express Business Checking, which offer up to 2.0% and 1.3%, respectively.

Lending

Since Oxygen is only a mobile banking app and not a full-fledged bank, it offers no lending options.

- 5% Cashback rewards

- Create virtual, single-use debit cards

- Business savings with 1% AP

- Virtual bank, no cash deposits

- Fewer integrations than other options

- No lending options

Why we chose it:

Oxygen is far from a traditional bank. It’s bringing style and innovation to the financial services sector and offering highly lucrative and feature-packed options for both personal and business bankers. Sign up today. To learn more about its services and fees, read our complete review on Oxygen.

Chase Business checking offers a strong account option if you’re looking for a traditional bank account where you can deposit cash. The bank offers a huge network of physical branches in addition to its sizable ATM network. Businesses in most states that need to deposit cash will find this to be a great option.

Chase offers business checking accounts with features like a business debit card and cash deposits at their brick-and-mortar locations. Unfortunately, it charges a monthly maintenance fee unlike most of its competitors.

Unfortunately, between the potential for fees and app, Chase ranks lowest on our list but with solid potential. Those needing a more robust online experience will find another option more appealing but traditional bank lovers who take cash from customers and need to deposit cash into their accounts regularly will find Chase to be worth taking a look at.

Fees

For a business checking account option, Chase has three offerings:

- Chase Business Complete Checking: $15/month waived off with $2,000 of minimum daily balance

- Chase Performance Business Checking: $30/month waived off with $35,000 combined average beginning day balance

- Chase Platinum Business Checking: $95/month waived off with $100,000 combined average beginning day balance

Each offers business checking accounts with features like a business debit card and cash deposits at their brick-and-mortar locations. Unfortunately, it’s not monthly maintenance fee-free like Bluevine.

Interest Rates

Chase Business Checking accounts offer no APY on deposits. However, businesses can earn interest with Chase Business Savings but you will have to inquire about what APY it offers you.

Lending

Chase for Business offers several lending options. Apart from its business credit card offerings, it has small business loans and lines of credit you can avail of. Business lines of credit range from $10,000 to $500,000 while loans start at $5000

- Accept payments through Chase mobile app

- International with locations worldwide

- Fraud protection

- Higher fees

- High minimum balance to waive fees

- Unclear APY on savings accounts

Why we chose it:

Chase business complete banking is a good option for a small business looking for some heavyweight banking options. Read our in-depth review on Chase business to learn more about its services. Sign up today.

Choosing the Best Small Business Bank Account for an LLC

For many people, the formation of an LLC marks a transition, changing their side gig for a bit of extra income to a serious business. There are many boxes to check in that process, but one of the most important may be choosing the best business checking account for your needs.

The primary benefit is to separate your personal checking account from your business bank account. However, a business checking account for your LLC can also offer a range of other benefits. Even a basic business banking account can offer lines of credit, invoicing services, and more. A business checking account might also come with merchant services, while a savings account can help your money grow.

In the past, LLC business owners had limited choices for business accounts, but using an online bank, with smaller fees and better rewards, is becoming more popular.

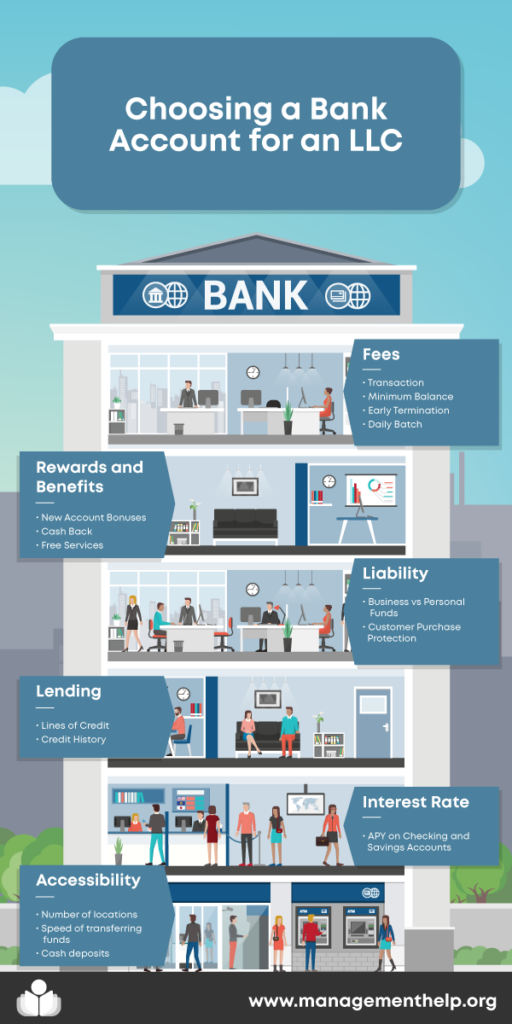

Fees—Transaction, Minimum Balance, Early Termination, Daily Batch

In many cases, the main concerns are monthly maintenance fees and other charges that can add up. Many banks offering accounts for LLCs have sought to attract small business owners by waiving monthly fees under certain circumstances or dropping monthly fees entirely. Fees can show up in many places, however, including

- Transaction fees

- Deposit fees

- Minimum balance

- Overdraft fees

The best business checking account for your needs won’t charge fees in areas important to your business. For example, offering unlimited transactions or free cash deposits per month.

Interest Rate—APY on Checking and Savings Accounts

Several banks on our list offer an APY on their checking accounts. Some of the top-ranked banks offer a yield as high as 2.0% which makes them a lucrative option for business owners. The higher the APY, the better it is for your business. However, note that some banks may offset your interest earnings by charging you monthly maintenance or transaction fees.

You can also earn interest on savings accounts, while you can earn interest on your primary checking with many of the best business bank accounts online. Again, the higher the interest rate offered, the better it is.

Liability—Business vs Personal Funds, Customer Purchase Protection

As the name implies, a limited liability company is intended to limit your financial liability in the event of a problem with your business. Even a basic business checking account for your LLC aids in that by separating your personal finances, creating a clear distinction between personal and business accounts.

Accounts for LLCs can offer more protection from certain types of liability than just a separate business bank account. Most bank accounts have fraud protection these days. If your bank also offers merchant services, it may add a layer of additional protection by covering the cost of customers who dispute transactions and similar problems.

Beware of “Mattress” Banking!

Did you know many online banks are crediting as low as 0.1%? You may as well stick your money under your mattress! Bluevine business checking accounts pay an APY up to 1.2% on balances up to $100,000.

Unlimited transcations with no monthly fees!

Lending—Lines of Credit, Credit History

You may have a personal credit rating, but your small business needs to establish its own credit history. Additionally, business owners may need small loans to cover payroll or billing, or larger loans for new equipment or a bigger space. A loan like that can be easier to get if you already have a business checking account with a particular institution. Developing a history with an institution can also improve the odds of bad credit business loan approval.

As a note, while we’ve focused on national and online banks, your local community bank or credit union might be a good option, especially if you’re anticipating needing a loan. Particularly for specialist businesses, the personal relationships common with local banks can be helpful.

Rewards and Benefits—New Account Bonuses, CashBack, Free Services

Even the best business checking account options tend to have a similar set of fees and services. Other factors may end up determining which bank is best for you. Offering some number of free cash deposits per month is common, as is online bill pay, or no minimum deposit requirements. Picking through those details can actually end up saving you money.

How to Open a Business Bank Account for an LLC

Opening a business bank account for an LLC is not a very complicated process. We answer some of the most important questions pertaining to LLC bank accounts in this section to give you a clear overview of the road ahead.

What Do I Need to Open a Bank Account For My LLC

With an online business checking account like Bluevine, you can set up your LLC bank account in no time. You only need the following information:

- Business name and address

- EIN (Employer Identification Number) or SSN if you’re a single-member LLC (Read more about how open a business account with EIN only)

- Date of LLC registration

- State where your LLC is registered

- Primary business location

- Personal information of the business owner (SSN, DOB)

What Other Documents Does the Bank Need to Open My LLC Bank Account?

While the documentation requirements vary from bank to bank, here’s what you can expect the bank to ask for.

- LLC Articles of Organization or Certificate of Formation

- LLC Operating Agreement

Just to be on the safe side, call or visit the bank’s website to make sure you’ve got everything you need to open a business bank account. This will help you avoid the hassle.

Do I Need an LLC to Open a Business Bank Account?

You can open a business bank account without an LLC. Any registered business can open a business bank account be it a sole proprietorship or a partnership. In the end, it all comes down to what you need to open a business bank account. Here are the different types of businesses and the documentation they need to create a bank account:

- Sole Proprietorship – DBA certificate

- Partnership – Business partnership agreement and business license if you operate an eatery or healthcare facility

- Corporation – Certified articles of incorporation, corporate bylaws, a signed corporate resolution, business license, and IRS 501(c) letter if you are a non-profit corporation

- Limited Liability Company (LLC) – Certified articles of organization, operating agreement, and business license. Learn more on how a corporation differs from an LLC here.

Want a business account for your sole proprietorship? Check out our list of the best banks for sole proprietorships.

Can I Open a Business Checking Account at a Credit Union?

Yes, you can open a business checking account at several credit unions. Digital Federal Credit Union, Navy Federal Credit Union, and America First Credit Union are some of the top-rated credit unions for opening an account.

Do LLCs Need a Specific Type of Bank Account?

There are no special LLC accounts as such. Most top-rated banks either offer checking or savings account and offerings vary from bank to bank. That said, a checking account can meet all the banking needs of an LLC if it’s in the right bank. We recommend Bluevine, Novo, and American Express Business Checking as the top-rated bank accounts for LLCs.

Do I need a separate bank account for my LLC?

You start an LLC to separate your personal and business finances. After formation, a Limited Liability Company becomes a separate legal entity from its owner. This is why we recommend creating a separate bank account for your LLC.

State and federal law don’t require you to create a separate bank account for an LLC. However, to make financial management easier and avoid trouble in the long run, it’s a good idea to have separate accounts. Plus, you can easily open a business account with free online banks like Bluevine and start reaping the benefits right away.

Can I use my personal bank account for my LLC?

You can technically, but we strongly advise against using your personal bank account for your LLC.

Forming a Limited Liability Company protects your personal assets in case something goes wrong with your business. However, if you keep using your personal bank account for your LLC, the authorities can come after your personal assets easily.

Create an LLC bank account for free with Bluevine and forget the trouble.

Frequently Asked Questions (FAQs) for Best Small Business Bank Accounts for LLCs

Still have questions about the best small business bank accounts for LLC? See if we answer them below.

Bottom Line on Best Small Business Bank Accounts for LLCs

Banks are often intimidating institutions, responsible for decisions that can make or break a business. However, you can take a lot of that control back by shopping around and finding the terms most favorable to you. After all, your small business is its customer and as the saying goes, the customer is always right.

Apply today and protect your personal finances with your LLC.

Best Business Bank Accounts by State

Below you will find an interactive U.S map that can help you locate and compare different banks and financial institutions that offer business accounts in your area.

Sections of this topic

Sections of this topic