A long time ago, I learned the importance of accepting market signals and using them to my advantage. It helped me become a better trader and successful investor. It allowed me to generate exceptional returns while limiting my risks. Some other investors have taken this concept on board, one of which is William Liebertson (also known as “Billy”), whose indicator has been used by investors for decades now.

Understanding to use Billy’s indicator properly

To use Billy’s indicator properly, you will need some solid knowledge about how spot prices in the crypto market fluctuate. You will have to be very familiar with the concept of “overbought” and “oversold,” as well as knowing what they mean.

Overbought

This is when a coin’s value has reached an unreasonable high point and presents a risk of possible decline. It is also a warning that buyers are about to initiate selling the asset.

Oversold

This is the opposite of overbought. It indicates too many sellers in the market, leading to a price decline. It is also a signal that can initiate buying of the asset.

This article will teach you how to identify these states with the help of Billy’s indicator – Williams R indicator, a fundamental market-based technical tool that is not trading software. If you want to practice using it in actual trading, you should run the system on a demo platform.

Algorithm Description and Explanation

William Liebertson was a great trader in his time; he predicted both bull and bear markets by analyzing various historical market data on multiple crypto-assets and using price action ignoring volatility (TAV). He did not have a good trading strategy, and all he used was the Williams R indicator. He has been using this indicator for decades now and is still using it up to this day in his trading strategies.

The fundamental market-based technical tool is an overbought-oversold indicator that can effectively be used with pre-defined price targets. This setup can help identify the state of a particular cryptocurrency at any given time, which we will discuss more later on.

The Williams R Indicator

The purpose of this indicator is to show when an asset is overbought or oversold. It indicates that an asset has reached its highest or lowest price during a specific period. This information can be invaluable when analyzing an asset’s potential and spotting market trends. You’ll need to be familiar with this indicator if you want to trade crypto successfully.

Williams R Indicator That is Used in Technical Analysis

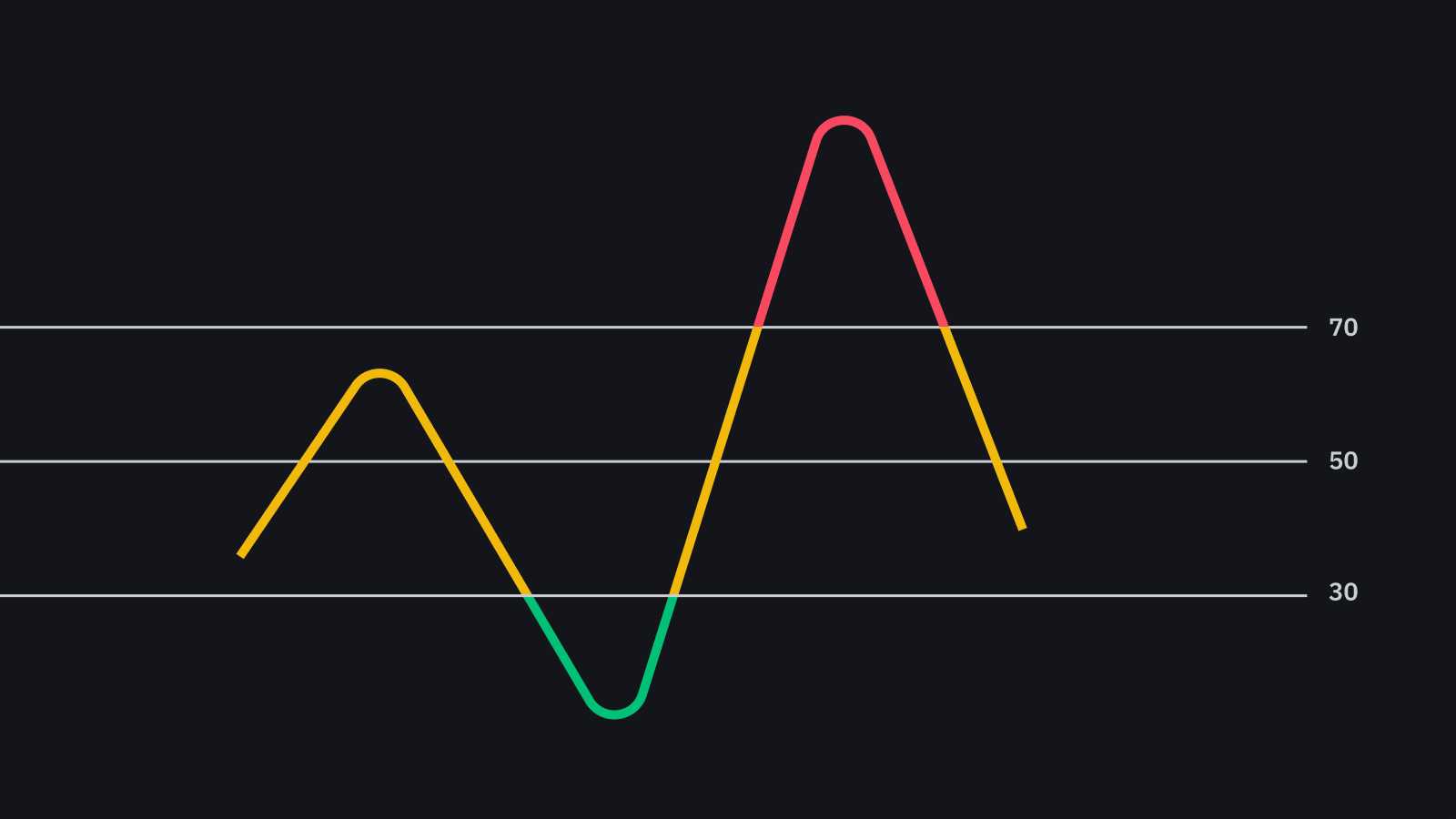

The red line represents the 14-day high and low price, whereas the blue line represents the 14-day Williams R-value. The indicator shows how much an asset has deviated from its mean. It also illustrates how far prices are likely to move after a breakout or breakdown when they reverse direction. This information helps traders and investors decide whether to buy or sell a specific coin at that particular time. It is not to be used as a trading signal but as a market analysis tool.

Overbought and oversold indicators help pinpoint possible price turns during various market conditions. The reason is that the outcome of price action moves in the opposite direction that it had moved in before getting to the overbought or oversold levels. This is especially true when using this indicator with relative strength index (RSI) and Williams R stochastic oscillator (WRSO).

Looking at Its Historical Volatility Level

The first thing you should know about identifying an asset’s volatility state is by looking at its historical volatility level. The volatility that an asset has experienced in the past helps figure out how its price may react depending on the current circumstances. For example, suppose an asset has a historical volatility level of 15 percent. In that case, this suggests that if there is rising demand for a particular coin and there’s a potential increase in buying volume, it is more likely to experience heavy swings in price. On the other hand, if it exhibited a volatility of 25 percent last year but only 5 percent this year, you can expect a much lesser impact from price fluctuations in the current market conditions.

In addition to looking at historical volatility levels as an indicator of asset movement, you should also consider how recent volatility has changed over time. High volatility is common in the early stages, whereas low volatility is seen during the final step.

Basing your decisions on market data only will not help you gain an edge in trading. It is of great importance that you know predefined price targets and how to identify them.

Comparing the Current Price of an Asset Against Its Mean

Comparing the current price of an asset against its mean or historical price can help determine its volatility state at that particular time. On the other hand, a comparison between an asset’s historical volatility and recent volatility can help you identify possible significant trading signals that are likely to occur in the future. It is essential to calculate what percentage of your trades will be successful if you want to develop a winning strategy.

An example of an overbought condition is when an asset’s actual price has moved above its mean. In this case, it would mean that the asset is overvalued. On the other hand, an oversold condition is when an asset’s actual price has dropped below its mean. In this case, it would suggest that the asset is undervalued. Once you understand these differences between an asset’s overbought and oversold states, you will be able to pick out whether its price is experiencing a bull market or a bear market.

Sections of this topic

Sections of this topic